Sampling tequila and mezcal in Mexico is a real delight, and to keep the buzz going it’s great to bring some bottles back to remember the good times. Whether you are buying boutique bottles unavailable in the US or maybe just trying to save a bundle, here’s what you need to know about bringing back tequila or mezcal from Mexico.

First a warning, this guide applies primarily to visitors from the US, other countries will have their own rules. Secondly, there are rules, and then there is how they are applied. Customs officers usually have bigger fish to fry than charging you a few dollars for extra bottles of tequila. Also, rules and taxes are subject to change, and their enforcement can depend on your port of entry or the particular customs officer you are dealing with.

Table of Contents

How many bottles of tequila can I bring back from Mexico?

- One bottle duty free

- Six or seven bottles by plane, with customs duty and taxes

- If crossing by land it depends on the state: California, up to 80 bottles; Arizona, no limit; New Mexico, “reasonable amount”; Texas, five bottles. Customs duty is still payable.

There are no federal limits set by the US for travelers importing alcohol for personal use. However, only one liter of alcohol per person will be duty free. Anything over that will be subject to federal and state taxes. The limit applies across all traveling group members, for instance four friends traveling together can import four liters between them, so you can use the limit of others if you are over yours.

If you are flying, there is a five liter limit per person imposed by the Federal Aviation Administration (FAA). Additionally the bottles must be unopened and in their retail packaging (meaning they will be labeled). Five liters works out at six standard 750 ml bottles. If you are buying 700 ml bottles then you can sneak in one extra and make it seven bottles.

If you are bringing back very large amounts and claiming it is for personal use, customs officers may get suspicious and have the power to make a determination against you. If you think this could be a risk, you can seek a pre-approval from the port of entry.

State restrictions

The amount of alcohol you can bring back without an import license varies by state. The rules of the state will be enforced by the customs agents at the airport where you land. These vary widely, for instance in California you can bring back 80 bottles of tequila but in Texas the limit is just one gallon which is only five bottles.

For example, in California the personal limit for importing alcohol by bus is 60 liters, which is about 80 bottles. According to their rules you can also import this amount by plane, but remember federal aviation regulations limit you to just five liters. If you are returning from Mexico to California by car or on foot you can only bring back one liter every 31 days, unless you are a non-California resident, then you can bring back 60 liters by car.

How many bottles of tequila can I bring back from Mexico by car?

You can bring back one liter of tequila by car without owing any taxes or duties. You can bring more than one liter if you pay customs duties but the amount depends on which state you are entering.

- California – 1 to 80 bottle limit (60 liters), depending on residency

- Arizona – no limit

- New Mexico – no limit

- Texas – 5 bottle limit (1 gallon)

Duty free allowances and bottle limits apply for a 30 day period. So you cannot bring back more than the limits unless at least 31 days has passed between trips.

Limits on bringing back tequila by car in California

| Mode of Crossing | CA Residents | Non-residents |

|---|---|---|

| Foot | 1 liter (~1 bottle) | 1 liter (~1 bottle) |

| Car or taxi | 1 liter (~1 bottle) | 60 liters (80 bottles) |

| “Common carrier” | 60 liters (80 bottles) | 60 liters (80 bottles) |

California residents can only bring back 1 liter of tequila or other spirit from Mexico every 31 days when traveling by car. Non-residents of California traveling from Mexico by car can bring back up to 60 liters of alcohol. This is equivalent to 80 bottles of standard sized tequila.

Californian residents can only bring back more than one liter of tequila if traveling via “common carrier”. Common carriers are commercial transport companies that have permits for interstate transport of alcohol. This can be via sea, rail or road. Check with your carrier to see if they carry this permit.

Source: California Department of Alcoholic Beverage Control

Limits on bringing back tequila by car in Arizona

There are no additional state restrictions on bringing back tequila into Arizona by car or other means. The federal rules apply. This means that you get the first liter dutyfree, then just have to pay duties and taxes on anything above that. You can bring as much alcohol into Arizona as you like, assuming it is for reasonable personal use.

Military members returning from duty may get approval for bringing back alcohol into Arizona without paying extra duties and taxes.

Source: Arizona Department of Liquor

Limits on bringing back tequila by car in New Mexico

There are no additional state restrictions on bringing back tequila into New Mexico by car or other means. The federal rules apply. This means that you get the first liter dutyfree, then just have to pay duties and taxes on anything above that. You can bring as much alcohol into New Mexico as you like, assuming it is for reasonable personal use.

Source: New Mexico Alcohol Beverage Control

Limits on bringing back tequila by car in Texas

You can bring back a maximum of one gallon of tequila or other spirits from Mexico to Texas. This is equivalent to about five bottles of tequila. These limits apply whether you are traveling by car or by air.

You can also bring back up to three gallons of wine and 24 12-ounce cans or bottles of beer.

You cannot bring back more than these limits. Any additional alcohol will be confiscated and destroyed. You can however allocate the total amount of alcohol among your group, so that that four people traveling together can bring back four gallons (20 bottles) between them. Each person would have to be over 21 years old.

Source: Texas Alcohol Beverage Control

What are the customs duties payable if I bring back more bottles?

If you have to pay customs duties when bringing back excess tequila to the US, it will cost between $4.53 and $17.71 per liter depending on your port of entry.

If you go over the one liter limit you are obliged to pay duty and taxes on any amount over this level. This includes federal, state, and local taxes based on the port of entry. The full amount of customs duties and taxes payable for alcohol over one liter depends on the state. The cheapest taxes are for travelers returning to New Hampshire who will pay only $4.53 per liter ($3.40 per bottle), the most expensive are for travelers to Washington who will pay an extra $17.71 per liter ($13.28 per bottle). The median tax payable across states on extra bottles of tequila is $10.69 per liter ($8 per bottle). These amounts are calculated based on a $50 value bottle of tequila.

| Import tariffs and taxes | ||

| $/liter | $/bottle | |

| Import tariff | 1.68 | 1.26 |

| Federal liquor tax | 2.85 | 2.14 |

| State liquor tax (median) | 1.60 | 1.20 |

| State and local sales tax (median) | 4.56 | 3.42 |

| Total Additional Taxes (median state) | 10.69 | 8.02 |

| Total Additional Duties and Taxes for Specific States | ||

| Houston, Texas | 9.29 | 6.97 |

| New York City | 10.67 | 8.01 |

| LA, California | 10.15 | 7.62 |

| Seattle, Washington (most expensive) | 17.71 | 13.28 |

| New Hampshire (least expensive) | 4.53 | 3.40 |

Federal tariffs and taxes work out at $4.53 per liter, or just $3.40 per bottle. State liquor taxes can vary widely – from zero in some states to $8.78 per liter in Washington, but most states are around $1.20 or less. State and local taxes will be in addition to this and are based on a percentage of the retail value of the tequila.

Some states may also add processing fees on top of this.

Import Duty on Tequila and Mezcal

The government likes to complicate things so there’s actually a different amount of tariffs payable for tequila and mezcal. Tequila is charged at $1.68 per liter and mezcal has a tariff of $1.78 per liter. This amount varies across all spirits, gin and scotch for example are charged $1.99.

Federal Excise Tax On Tequila

Federal excise is $13.50 per “proof gallon”. A proof gallon is a gallon at 50% alcohol. Tequila is commonly at 40%, so a proof gallon of tequila would be 1.25 gallons. This works out at $2.85 per liter.

State Excise Taxes on Tequila

State taxes vary widely. The highest charging state by a long way is Washington. They charge $33.22 per gallon. The lowest taxing states are New Hampshire and Wyoming who technically don’t have a tax on spirits, however all spirit sales are controlled by the state. California charges $3.30, Texas $2.40 and New York $6.44.

State and Local Sales Tax

State and local sales taxes will also be applied to extra bottles of tequila. Unlike the other taxes, these taxes are based on the value of the tequila, not the amount. You’ll most likely have to nominate a value in US$ for this tax to be applied. It is unlikely you will be asked for receipts, and if you can’t remember the exact value, a reasonable approximation should be ok.

Admin Fees

Some states may charge additional processing fees when you pay for duty and taxes. For example, Texas charges a $3 administrative fee when collecting duties.

What if I bring back more alcohol than my limit?

With all of the various regulations it can be confusing to work out your limit for bringing back alcohol to the US. The limits for flying are different than when going overland, and each state also has different rules. For example, aviation rules limit you to five liters when flying, but in Texas the limit is 3.8 liters (one gallon). In these cases the more restrictive limit will apply.

If you bring back more alcohol than is permitted, then US Customs and Border Protection officers may confiscate and destroy any extra amounts. You may get some leeway if you are only a little over the limit. Another thing to consider is the limit applies across everyone in your traveling group – do you have fellow travelers you could allocate any extra to?

Can I bring more than five liters on a plane?

According to Federal Aviation Administration rules, the limit for carrying spirits in checked luggage is five liters per person. Mexican aviation rules also limit alcohol to five liters per person.

One person with two or more checked bags can still only officially carry five liters of alcohol. Conversely two people sharing one checked bag can technically carry 10 liters of alcohol. However, weight restrictions are likely to come into play and carrying that many glass bottles together risks breakage. Further, as the bag will be checked in one person’s name it would not be possible for baggage inspectors to understand this, and there is risk that additional quantities are confiscated.

There are reports of departing passengers having additional bottles removed to get under the five liter limit. If the bottles are spread between multiple bags it is very unlikely that this would occur.

How do I declare extra bottles of tequila to customs when I return?

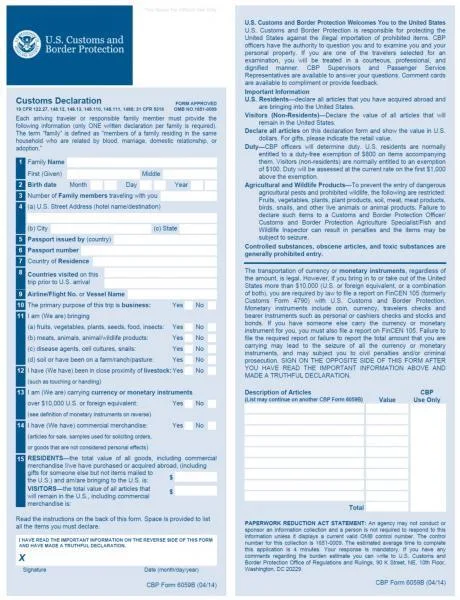

In earlier years incoming passengers to the US filled out a customs declaration form, which were usually handed out on the plane prior to arrival. These forms don’t directly question if you are bringing in alcohol, but there is space to write what goods you have purchased and their value.

More recently this process has moved to electronic, with some questions being asked when you use the electronic kiosks. In recent months it seems in most cases you are not directly asked to declare. Officially, the onus is still on you to declare to customs officers if you are bringing in items subject to duty.

If you end up having to pay additional duties and taxes, you must do this at the port of entry prior to leaving.

Do customs officers really check for tequila bottles?

According to my own experience and multiple reports online, it’s unlikely that a customs officer will check if you have more bottles of alcohol than your limit, and even if they do, it’s unlikely they will actually make you pay additional taxes. The likely outcome is you get a warning. The fact is that checking alcohol limits is a low priority for border officers who are much more focussed on security and stopping illicit substances.

However, experience can vary depending on the port of entry. Texas land borders are apparently more strict and more likely to charge or confiscate excess bottles.

If you are bringing back quantities that appear commercial, for example a case or more of just one brand, customs officers are likely to be stricter. If the bottles are more obviously for personal use you will have less trouble.

Can I bring tequila in my carry-on for my flight?

You can only carry your tequila on a flight if it is in bottles of 100 ml or less, or if you bought a full size bottle duty free and it is in a tamper-proof bag. Many brands of tequila come in 50 ml mini bottles for example. But before you get too excited, FAA rules mean you are not allowed to drink your own alcohol on flights.

Is tequila cheaper to buy duty free at the airport?

No, tequila is more expensive at Mexican duty free than if you bought it at most shops. Also, Mexican airports are not known for their great selection in tequila so if there is a particular brand you are looking for don’t count on finding it at the airport. Depending on the airport and the terminal there may be some well known brands and more likely some tourist-targeted creations.

Major Mexican supermarkets often have very good selections of brands at much lower prices than you will find at the airport. Some supermarkets to look out for are Chedraui, Fresko, La Comer and La Europea (smaller but with a wider range of boutique labels and still good prices). Walmarts also stock a decent range of the more popular brands at lower prices. If you are a Costco member you can take advantage of your membership in Mexico. While cheap, the range of tequila brands at Costco is more limited than other options.

Is mezcal cheaper to buy duty free at the airport?

No mezcal is likely to be more expensive if you wait to buy it duty free at the airport in Mexico. Similar to tequila, the range of mezcals at Mexican airports is likely to be very limited. If you can, try and buy your mezcal ahead of time – ideally at a shop focussed on mezcal, but otherwise most La Europea stores have a very good selection at decent prices.

How should I transport the bottles?

Having broken more than one glass bottle in my luggage before I always take extra attention when packing. Here are some tips for packing tequila bottles in your luggage:

- Avoid the edges – when placing the bottle make sure to stay away from the sides, back and front and top and bottom of the suitcase. Pad from all angles as you never know where the impact may be coming from.

- Anything can be used for padding – there are special bottle bags you can get with bubble wrap and they work great, but so do sweaters, t-shirts, towels, crushed newspapers etc.

- Protect top and bottom – depending on shape the top of the bottle can be most fragile. I’ll often put either end of bottles into a running shoe with some socks to add extra cushioning.

- Avoid other bottles and hard items – just as you avoid the sides of the suitcase, make sure to add padding between different bottles and other hard objects to keep them from clashing into each other.

- Plan for the worst and wrap it up – even with the best intentions there’s a chance the bottle will break, and if that happens you don’t want all your t-shirts smelling of tequila. One plastic bag is good, two is better, zip-locks are best. The broken glass can still break through the plastic but hopefully most of the spill will be contained.

How much does a bottle of tequila weigh?

A typical glass bottle of tequila weighs 2.65 lbs or 1.2 kgs. If you are taking six bottles back, this comes to 15.9 lbs, or 7.2 kgs. This can use up a decent portion of your checked bag weight limit, and more if you are using extra packaging.

The usual weight restrictions for checked baggage is 50 lbs or 23 kgs. First and business class travelers can sometimes take up to 70 lbs or 32 kgs. Be careful to check the rules for your specific ticket, as cheaper fares often have lower limits.

What else do I need to know when traveling with tequila or mezcal?

- You still need to be at least 21 years to bring back tequila to the US, even if it is for a gift. In Mexico the legal drinking age is 18 so you may not have any trouble buying alcohol, but once you’re back in the US, US laws apply.

- Bottles should be sealed (unopened) and in their retail packaging. It’s common for some producers, particularly mezcal producers in Oaxaca, to just provide bulk mezcal and you bring your own bottle to fill. If you can’t get a sealed bottle the risk is small that border officers will give you trouble but keep this in mind if you want to follow the rules. Most mezcal tour guides should be able to provide bottles that they can seal and label, with alcohol content labeled.

- Some producers infuse their products with cannabis, more common in mezcal. Marijuana is still illegal federally in the US so be careful not to bring back anything that may get you in trouble.

- Tequilas sold in Mexico are often lower proof than the same brand sold in the US. For example, the Don Julio range is 35% to 38% alcohol by volume for the Mexican versions, compared to 40% when sold in the US.

- Aviation rules also limit the alcohol percentage to 70% (140 proof) however this isn’t a concern for tequila or mezcal which are always under this level. The regulated maximum alcohol content for both tequila and mezcal is 55%.

Can one bring back an open bottle of tequila driving across the border Mexico to US?

That shold be fine but keep it in your trunk. There don’t seem to be any restrictions on open alcohol from a border/customs perspective but you’d still need to follow state rules. For example, in Texas and California you cannot drive with an open container of alcohol that’s accessable. You can drive with an open bottle of tequila or other alcohol if it’s in the trunk or locked glovebox. If your car or truck doesn’t have a trunk (eg a Jeep) you can keep the bottle behind the last row of seats.

I’ll be driving to Rosarito for a month. Can I buy tequila from a distillery and have it shipped to Rosarit?